Full financial Model with all calculation scheduals

Creating a Five Year Forcasting Model

Download Excel

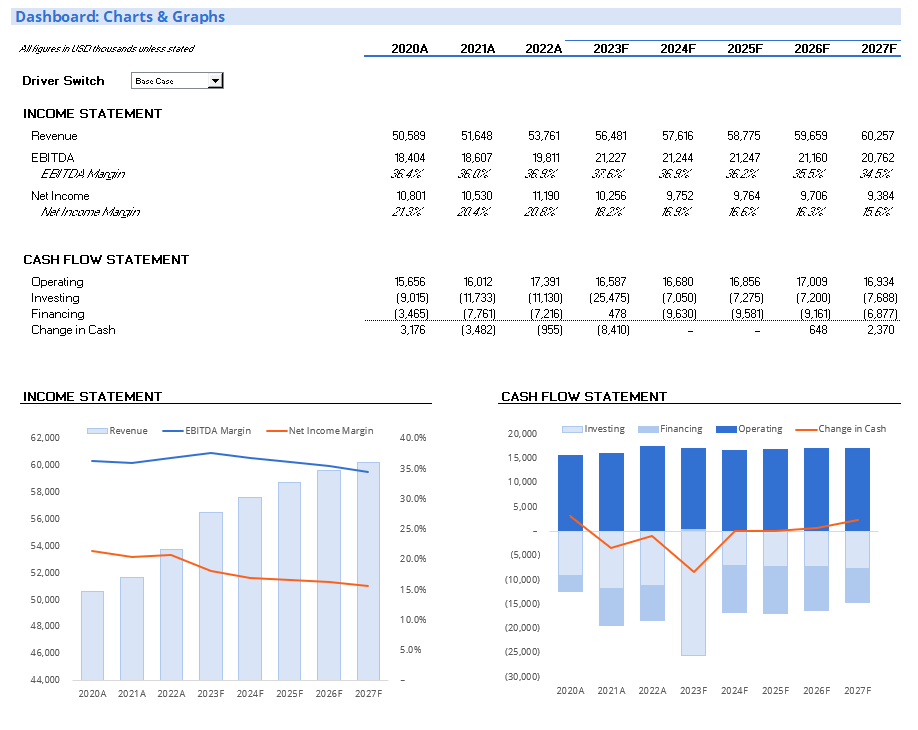

| All figures in USD thousands unless stated | ||||||||

|---|---|---|---|---|---|---|---|---|

| Model Running: Base Case Drivers | 2020A | 2021A | 2022A | 2023F | 2024F | 2025F | 2026F | 2027F |

| Inflation | 2.4% | 2.2% | 2.3% | 3.5% | 3.0% | 3.0% | 2.5% | 2.5% |

| Revenue | 50,589 | 51,648 | 53,761 | 56,481 | 57,616 | 58,775 | 59,659 | 60,257 |

| COGS | (24,544) | (25,104) | (25,779) | (26,798) | (27,663) | (28,557) | (29,303) | (30,070) |

| Gross Profit | 26,045 | 26,544 | 27,981 | 29,683 | 29,953 | 30,218 | 30,356 | 30,187 |

| SG&A | (5,877) | (6,006) | (6,144) | (6,359) | (6,550) | (6,746) | (6,915) | (7,088) |

| Other | (1,764) | (1,931) | (2,026) | (2,097) | (2,160) | (2,225) | (2,280) | (2,337) |

| EBITDA | 18,404 | 18,607 | 19,811 | 21,227 | 21,244 | 21,247 | 21,160 | 20,762 |

| Depreciation | (2,960) | (3,196) | (3,452) | (5,350) | (6,163) | (6,521) | (6,883) | (7,255) |

| EBIT | 15,444 | 15,411 | 16,359 | 15,877 | 15,081 | 14,726 | 14,278 | 13,507 |

| Interest Expense | (1,688) | (2,200) | (2,350) | (1,268) | (1,149) | (777) | (416) | (120) |

| Interest Income | 200 | 180 | 193 | 42 | – | – | 3 | 18 |

| EBT | 13,956 | 13,391 | 14,202 | 14,651 | 13,931 | 13,949 | 13,865 | 13,405 |

| Current Tax | – | – | – | (2,866) | (3,309) | (3,508) | (3,660) | (3,684) |

| Deferred Tax | (3,155) | (2,861) | (3,012) | (1,530) | (870) | (677) | (499) | (338) |

| Total Tax | (3,155) | (2,861) | (3,012) | (4,395) | (4,179) | (4,185) | (4,160) | (4,022) |

| Net Income | 10,801 | 10,530 | 11,190 | 10,256 | 9,752 | 9,764 | 9,706 | 9,384 |

| 2020A | 2021A | 2022A | 2023F | 2024F | 2025F | 2026F | 2027F | |

|---|---|---|---|---|---|---|---|---|

| All figures in USD thousands unless stated | ||||||||

| Model Running: Base Case Drivers | ||||||||

| CASH FROM OPERATING | ||||||||

| Net Income | 10,801 | 10,530 | 11,190 | 10,256 | 9,752 | 9,764 | 9,706 | 9,384 |

| Deferred Taxes | 3,155 | 2,861 | 3,012 | 1,530 | 870 | 677 | 499 | 338 |

| Depreciation | 2,960 | 3,196 | 3,452 | 5,350 | 6,163 | 6,521 | 6,883 | 7,255 |

| Cash From Accounts Receivable | (600) | 300 | 100 | (339) | (140) | (143) | (109) | (74) |

| Cash From Inventory | (400) | (400) | (200) | 174 | (59) | (61) | (51) | (52) |

| Cash From Accounts Payable | (260) | (475) | (163) | (382) | 95 | 98 | 82 | 84 |

| Subtotal | 15,656 | 16,012 | 17,391 | 16,587 | 16,680 | 16,856 | 17,009 | 16,934 |

| CASH FROM INVESTING | ||||||||

| Capital Expenditure | (9,015) | (11,733) | (11,130) | (25,475) | (7,050) | (7,275) | (7,200) | (7,688) |

| Subtotal | (9,015) | (11,733) | (11,130) | (25,475) | (7,050) | (7,275) | (7,200) | (7,688) |

| CASH FROM FINANCING | ||||||||

| Change in Long-Term Debt | - | (4,000) | (4,000) | (4,000) | (4,000) | (4,000) | (4,000) | (4,000) |

| Change in Revolving Credit Line | - | - | - | 7,529 | (2,680) | (2,629) | (2,220) | - |

| Change in Common Equity | - | - | - | (1,000) | (1,000) | (1,000) | (1,000) | (1,000) |

| Dividends | (3,465) | (3,761) | (3,216) | (2,051) | (1,950) | (1,953) | (1,941) | (1,877) |

| Subtotal | (3,465) | (7,761) | (7,216) | 478 | (9,630) | (9,581) | (9,161) | (6,877) |

| CASH BALANCE | ||||||||

| Beginning of the Year | 9,671 | 12,847 | 9,365 | 8,410 | - | - | - | 648 |

| Increase / (Decrease) | 3,176 | (3,482) | (955) | (8,410) | - | - | 648 | 2,370 |

| End of the Year | 12,847 | 9,365 | 8,410 | - | - | - | 648 | 3,018 |

| 2020A | 2021A | 2022A | 2023F | 2024F | 2025F | 2026F | 2027F | |

|---|---|---|---|---|---|---|---|---|

| All figures in USD thousands unless stated | ||||||||

| Model Running: Base Case Drivers | ||||||||

| ASSETS | ||||||||

| Cash | 12,847 | 9,365 | 8,410 | – | – | – | 648 | 3,018 |

| Accounts Receivable | 5,708 | 6,333 | 6,624 | 6,963 | 7,103 | 7,246 | 7,355 | 7,429 |

| Inventories | 1,792 | 1,923 | 2,009 | 1,835 | 1,895 | 1,956 | 2,007 | 2,060 |

| Total Current Assets | 20,347 | 17,621 | 17,043 | 8,799 | 8,998 | 9,202 | 10,010 | 12,507 |

| Property Plant & Equipment | 59,192 | 67,729 | 75,407 | 95,532 | 96,419 | 97,173 | 97,490 | 97,923 |

| Total Assets | 79,539 | 85,350 | 92,450 | 104,331 | 105,417 | 106,375 | 107,501 | 110,429 |

| LIABILITIES | ||||||||

| Accounts Payable | 3,024 | 3,205 | 3,319 | 2,937 | 3,032 | 3,129 | 3,211 | 3,295 |

| Revolving Credit Line | – | – | – | 7,529 | 4,849 | 2,220 | – | – |

| Total Current Liabilities | 3,024 | 3,205 | 3,319 | 10,466 | 7,880 | 5,350 | 3,211 | 3,295 |

| Deferred Taxes | 4,155 | 7,016 | 10,028 | 11,558 | 12,428 | 13,105 | 13,604 | 13,942 |

| Long-Term Debt | 28,000 | 24,000 | 20,000 | 16,000 | 12,000 | 8,000 | 4,000 | – |

| Total Liabilities | 35,179 | 34,221 | 33,347 | 38,023 | 32,308 | 26,455 | 20,815 | 17,237 |

| EQUITY | ||||||||

| Common Equity | 38,670 | 38,670 | 38,670 | 37,670 | 36,670 | 35,670 | 34,670 | 33,670 |

| Retained Earnings | 5,690 | 12,459 | 20,433 | 28,638 | 36,439 | 44,251 | 52,016 | 59,523 |

| Total Shareholders' Equity | 44,360 | 51,129 | 59,103 | 66,308 | 73,109 | 79,921 | 86,685 | 93,192 |

| Total Liabilities & Equity | 79,539 | 85,350 | 92,450 | 104,331 | 105,417 | 106,375 | 107,501 | 110,429 |

| Check | – | – | – | – | – | – | – | – |

Download Excel